Do RFID Wallets Work? Absolutely, and Why You Need One

Thanks to advancements in cybersecurity, surveillance, and other technologies, theft and fraud have dramatically declined in the digital age. We are far more likely to remain safe and secure, and our information is much better protected than in decades past.

Unfortunately, some concerns still remain about our digital security, and criminals are constantly scheming new ways to illegally obtain our most valuable assets. RFID skimming is one of the lesser-known methods by which fraudsters steal from us and remain completely unknown.

To combat this scary form of credit card fraud, we need to equip ourselves with the proper protection, which means gearing up with an RFID-blocking wallet, and taking other precautions to keep our data safe. Here’s a closer look at how this powerful technology can save you from fraud and why you should consider picking up an RFID-blocking wallet today.

What Is RFID Skimming?

Radio Frequency Identification, or RFID, is a powerful technology used in a huge variety of industrial, consumer, and military applications for decades. Using electromagnetic fields to detect and read information from designated tags, we can streamline complex processes like financial transactions worldwide while ensuring security for all parties involved.

The technology is not new, but it has seen widespread mainstream adoption in recent years, with RFID markets growing at a rate of $5 billion every few years. Nowadays, it’s rare to find a new credit card that does not incorporate some type of RFID technology as a standard feature.

There are nearly 100 million contactless debit and credit cards currently in use, and retailers have even started to tag their in-store products with RFID for added speed and convenience.

But while RFID is a miraculous technology with tons of upside, it’s not completely immune to fraud. Thieves use RFID skimming to steal information directly from the pockets of unwitting card users, siphoning money, and misusing data in other nefarious ways.

By simply standing in close proximity and using basic RFID scanning technology, a fraudster can gain access to all of the key components of your credit card, from the number and name to the expiration date and security code. They can even submit this info to get a duplicate card of their own.

How Common Is RFID Theft?

You’d think that RFID theft is only something you’d see in a spy movie or a sci-fi novel, but the truth is that this form of fraud is quite common in the modern era.

In 2016 alone, credit card fraud was responsible for nearly $23 billion in losses, with RFID skimming reported as a major piece of the pie. This makes things more expensive and inconvenient for everyone involved, from consumers and companies to insurance agencies and governing bodies.

The scary part is that RFID skimming can happen almost anywhere, at any time, as long as you have your debit or credit card in your pocket, backpack, or bag.

Your card info can be skimmed whether you’re browsing a grocery store or clothing boutique, riding on crowded public transportation, sitting down to eat at a restaurant, or pumping gas at a rest stop.

Some scammers even set up their operations at ATMs, meaning you can be withdrawing money from your account in public while criminals are withdrawing the same amount without you knowing.

RFID skimming isn’t necessarily easy to pull off, but considering how fast technology is developing, it’s something we should all be aware of and work to take active measures against the trend.

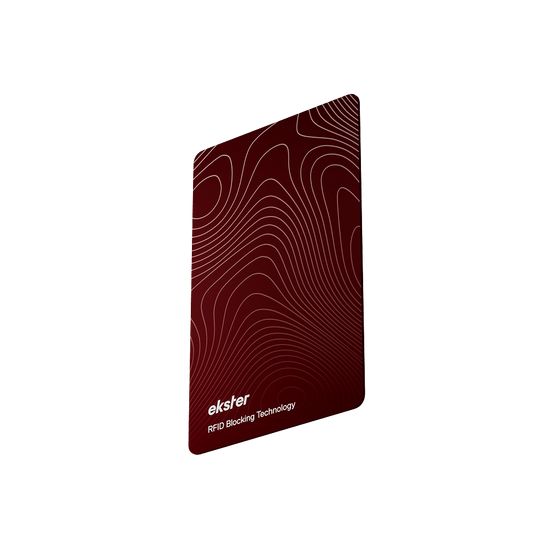

RFID Blocking Technology

Spooked by the prospect of RFID skimming happening to you? If you live in a densely populated area, spend a lot of time in public, and rely on credit cards to make daily purchases, you are in the demographic most likely to be a victim of skimming. Age, gender, and income don’t matter.

Luckily, you have the power to protect your accounts and your identity by taking one simple step: swapping your current wallet out for one with RFID-blocking technology.

RFID blocking can work in a few ways. In high-stakes settings like military intelligence, operators will actively deflect or scramble RFID signals to throw adversaries off the trail and prevent an attack on critical systems. For normal folks carrying around some credit cards, a passive shield can absorb or deflect the RFID signal and stop thieves from gaining access.

Be aware that multiple types of signals can be used to swipe your information, so you need high-grade blocking materials that prevent Bluetooth, Wi-Fi, NFC, and 5G signals from sabotaging your data.

Find a premium leather wallet that looks great and also comes standard with the best RFID blocking technology available to the public. You will gain peace of mind by protecting your valued digital assets and send a message to fraudsters that their efforts are all for nothing.

You don’t have to walk around with a military-grade briefcase to keep your data safe. A classic bi-fold wallet with the right RFID-blocking ability is all you need to significantly boost your security.

Other Tips To Combat Fraud

An RFID blocking wallet can do a lot of the heavy lifting in terms of protecting you from fraud, but you need to employ other tactics and habits to ensure your information is secure at all times.

The first step is to bundle your RFID cards close together in your wallet since this will limit a thief’s ability to target and skim from any particular card in your possession. Look into getting a wallet with a contained storage mechanism and quick-trigger release feature that always keeps your cards close.

Next, consider switching up how you carry your wallet around. Instead of keeping it in your back pocket like most people, downsize your wallet and store it in your front pocket. Criminals are far less likely to target this area in most cases.

Finally, be aware of your surroundings when navigating public spaces and do a quick scan of your environment before you pull out your credit card to pay for items in a store or restaurant. Use cash for smaller purchases, and never leave your card out on the table for more than a few seconds.

Future-Proof Your Wallet

RFID blocking is an effective way to combat fraud, and you can exercise greater caution to protect your information in public as well. Still, there are even more “smart wallet” features to look for that give you extra layers of security.

A wallet tracking card, for instance, can help you find your wallet quickly if you leave it behind or it happens to be stolen from your pocket.

A modular folio attachment for your phone case can keep your cards, cash, and smartphone all in one place, reducing the profile of your everyday carry and minimizing the chances of fraud.

As more smart wallet features are released in years to come, stay on the cutting edge and remain one step ahead of the hackers and thieves.

Conclusion

RFID technology can be used for good or evil, and you need to defend yourself against those who intend to steal your digital information. Level up your wallet security with RFID blocking and don’t hesitate to incorporate new smart wallet tech into your everyday carry.

Sources:

https://www.creditcards.com/credit-card-news/rfid-blocking-wallet-worth-it/

https://rfidcloaked.com/what-are-rfid-cards/explaining-rfid-blocking-tech-types

https://www.ifsecglobal.com/global/understanding-rfid-skimming-infographic/