Why You Need an RFID Card In Your Wallet

You know how you lock your front door, never leave your phone lying around, and maybe even double-check if you turned off the stove before bed?

Think of an RFID card like doing that for your bank and credit cards. It might feel like overkill… until something weird happens.

Here’s the deal: RFID protection is real, card skimming is happening (more than you might think), and an anti-theft card like ours at Ekster isn’t just “nice to have.” It’s smart.

Let’s dive into what RFID theft is, why it’s a thing you need to care about, and how an RFID Card gives you serious peace of mind.

What the Heck is RFID & RFID Skimming?

RFID (Radio-Frequency Identification) is the tech that lets your card or badge communicate wirelessly over very short distances. Think contactless payments, tap-to-pay, RFID-based access badges.

Card skimming is when someone with the wrong intentions uses a reader or scanner to steal (skim) card info. That info might let them make unauthorized purchases, clone cards, or commit identity theft. Sometimes skimming happens via magnetic stripes or compromised terminals; RFID/NFC introduces another vector.

Many cards using RFID/NFC have built-in security: encryption, short read distances (just a few centimeters), etc. So risk isn’t everywhere or all the time. But because risk exists, especially in crowded areas or when you aren’t paying attention, it’s smart to take simple precautions.

How Big is the Problem of RFID Theft?

Here are some real numbers showing why corporate credit card protection or bank card protection via anti-theft tools is more than just paranoia:

According to a Security.org report, 62 million Americans experienced credit card fraud in just one year.

That’s nearly 63% of U.S. credit card holders. And only about 8% of those involved cards physically stolen. The rest is fraud via other means (data, scanning, etc.).

In 2022, US card skimming events grew nearly 5× compared to previous periods, per FICO data. In the first half of 2022, there was a 700%+year-over-year increase in certain card skimming fraud reports.

A Cupertino example of a survey: with contactless payment cards growing, more cyber criminals are turning to RFID-credit card theft via scanning, though the reported incidents are fewer (because detection is hard). Still, with increased exposure comes increased possibility.

Those numbers relate to credit card fraud and skimming in general, not always exclusively RFID/NFC theft. But they show that identity theft protection and credit/debit card protection are not trivial; they’re becoming more urgent.

RFID Threats You Need to Look Out For

Even if long-range RFID remote scanning (15-20 feet, etc.) is largely overhyped (experts suggest it’s not credible), there are more plausible threats:

1. Someone with a portable reader could pass closely (like in a crowd, in a bag, in a pocket) and try to access data on your contactless card.

2. If your card is exposed (wallet flap open, loose cards in a bag, etc.), the chance of proximity increases.

3. Fraudsters often combine multiple weak points: e.g. card skimming + exposed card numbers elsewhere. Once data is out, damage stacks up.

Even if the likelihood per person is small, the consequence can be big—identity theft, unauthorized purchases, hours of dispute, and damage control.

So yeah, while we don’t want to blow things out of proportion, ignoring the risk is like leaving your door unlocked because you believe your neighborhood is “safe enough.” Maybe it is. But you wouldn’t do that with your money, right?

How an RFID Card Helps and What It Does

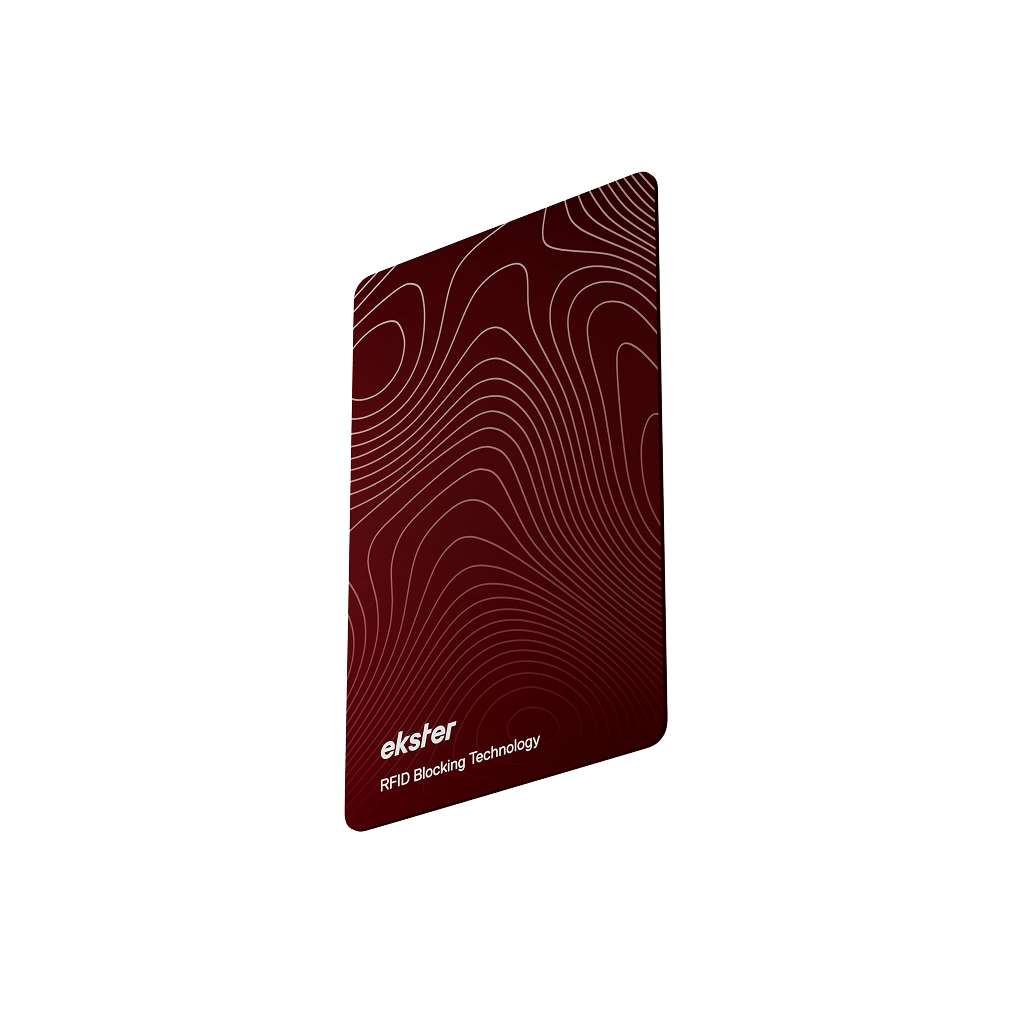

Here’s where the product meets peace of mind. An anti-theft card or RFID blocker Card works quietly in the background, giving you a layer of invisible security every time you step outside.

The main job of an RFID Card is to block unwanted signals. When it sits next to your debit, credit, or ID cards, it acts like a shield against RFID and NFC readers. That means thieves with wireless skimmers won’t be able to pick up your card info… even if you’re shoulder-to-shoulder on a crowded subway.

It’s also designed to be as slim and familiar as the cards you already carry. No chunky gadgets or awkward cases; it slides right into any wallet, cardholder, or pocket. The best security tool is the one you’ll actually use, and this one disappears into your everyday carry without adding bulk.

Another win? It doesn’t need batteries or a power source. The materials themselves do the heavy lifting, so your RFID Card works continuously without charging, switching on, or any maintenance at all. You pop it in once and forget about it.

And ultimately, it’s about protection on multiple levels. Sure, you still need to be smart with your data online. But in the physical world, this card gives you a literal barrier against digital pickpockets.

Consider it an extra guard in your wallet (even if it has built-in RFID protection), keeping your money and identity super safe.

Objections and Myths About RFID Skimming

MYTH 1

“RFID attacks are super rare—why worry?”

REALITY

True, the most dramatic attacks are rare. But fraud numbers show every year more stuff gets compromised. Also, even “rare” is too much when your info (or money) is at stake.

MYTH 2

“My bank/credit card already has encryption or chip tech.”

REALITY

Great, many do. But security is layered. An RFID card doesn’t replace those protections; it adds one more protective layer.

MYTH 3

“RFID blockers are bulky or inconvenient.”

REALITY

Not necessarily. A good RFID card is slim, credit-card-sized, and unobtrusive. You place it next to the cards you want protected. Done.

MYTH 4

“If theft is theoretical, maybe I’m just being paranoid.”

REALITY

Paranoid by preparation is wise. We see from scam data that criminals adapt quickly. Being proactive helps you avoid the stress, cost, and time of having to clean up identity theft.

Scenarios Where Having an RFID Card Saves You

When you’re commuting with your wallet in a back pocket, bag, or coat that’s open/unzipped.

In crowded places (train station, concert, shopping mall) where someone could slip a reader close.

At airports or in queues, where multiple contactless cards, passports, and badges are nearby.

While traveling, you often carry more cards, IDs, and passports, so you may be more distracted and susceptible to RFID theft.

Having an RFID Card means you can mostly forget about RFID risks. It’s not perfect (no security tool ever is), but it drastically lowers them.

Final Word: Why Your Wallet Needs an RFID Card

At Ekster, we believe security should be simple. Our RFID Card is that simple layer of protection: nothing to remember, nothing to charge, and nothing bulky. It’s like wearing a seatbelt for your cards.

When you carry cards, you carry risk. But with the right protection, risk turns into peace of mind.

And the cost of peace of mind? Tiny. The benefit? Big.

Put the RFID Card in your wallet. Sleep a little better knowing you didn’t leave your back door open.

SHOP THE EKSTER RFID CARD

FAQ

What is RFID protection?

RFID protection means using materials or tools (like RFID cards) that block or shield your contactless cards, IDs, and passports from unauthorized scanning signals. It helps prevent data theft/skimming.

How does RFID card protect my credit and debit cards?

When placed next to your cards, the RFID blocker card acts like a barrier that stops RFID/NFC readers (especially hidden or portable ones) from reading the signal. So your card’s data remains private.

Does every bank card use RFID or NFC?

Not all, but many do now. Most contactless credit and debit cards use NFC (a form of RFID). There are still cards with only magnetic stripes or chips that need physical contact. If yours has the contactless symbol (a sideways WiFi-type icon), then it likely uses RFID/NFC.

Is identity theft protection really necessary for everyday card users?

Yes. Even if you don’t travel or live in big cities, digital exposure (contactless payments, data breaches, etc.) means risk is everywhere. Protection tools like RFID cards are inexpensive layers that help prevent worst-case scenarios.

Can someone steal my card data from far away?

Usually not. Experts say most RFID/NFC cards need to be very close (a few centimetres or inches) to a reader. Long-distance scanning claims (15-20 feet etc.) are largely unsubstantiated. But “very close” still counts—crowded areas or unsecured wallets are real risk zones.

Do barcode or magnetic stripe skimming and RFID skimming use the same methods?

No, they’re different. Magnetic stripe skimming involves copying data from the swipe area using devices installed on ATMs or POS terminals.RFID/NFC skimming tries to read wireless signals transmitted by the card. But methods overlap in that they all try to steal data; protection must be multi-layered.

Is an RFID wallet enough, or should I also have an RFID card?

An RFID wallet is great—it often gives built-in protection. But an RFID Card gives flexible, additional protection: you can add it to any wallet, use it for extra cards you carry elsewhere (e.g., in bags), and give yourself peace of mind even when you’re using non-shielded accessories.