Covid-19 and the rise of Contactless Payments

The revelation that paper money can carry more germs than a household toilet holds a lot more weight in 2020. Though we’ve always known money was dirty, only now is it commonplace to see a cashier wearing plastic gloves to collect your change. We’ve seen a revolution in cleanliness this year, and one word more than others is on everyone’s mind: contactless.

[Pictured above: Parliament Wallet]

There’s a new fear surrounding touch, from our friends and family members to the banal items that we interact with. Items like doorknobs and credit cards suddenly seem like sleeper agents - silently waiting to infect you without your knowledge. Shops and restaurants are starting to switch over to contactless payment methods precisely for this reason. But this trend didn’t start with Covid-19…

The switch the contacless payments

From their creation in 2007, contactless payments and devices have exploded as the fastest growing method for transactions. Once a novel technology, a no-touch payment option is now accepted at 67% of retailers in the U.S. and this number continues to rise. The last few years have seen consistent growth in the popularity of contactless transactions for a few main reasons:

-

Faster: contactless payments work twice as fast as other methods.

-

Safer: better encryption prevents mistakes between customer and business.

-

Easier: customers can make payments from within a wallet, without having to remove their card.

[Pictured above: Senate Cardholder in Blush Beige]

What is contactless payment?

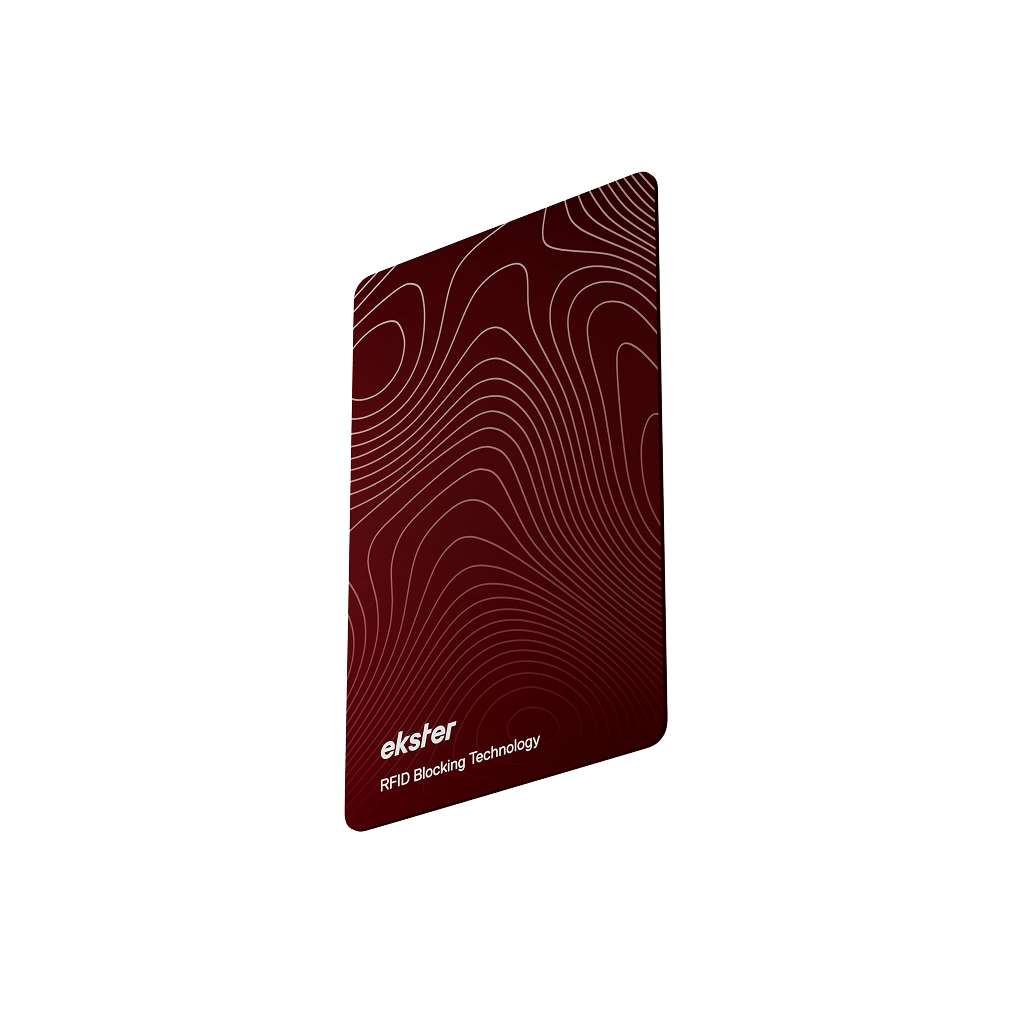

The technology behind contactless payment works like an invisible fingerprint: if your card is the finger, the machine that completes the transaction is the scanner. Inside every contactless device is a small RFID chip that holds encrypted data connected to your identity, bank account, or countless other information. When you hold a contactless device near a reader it communicates your information, verifying your identity, and whether you have money to pay. Nowadays it's common to find this technology in credit and debit cards, gym cards, travel cards and even passports.

-

Cellphones, cards, stickers, keychains and watches can all be made into contactless devices.

-

Contactless cards use RFID (radio frequency identification) to communicate with readers.

-

RFID makes transactions between customers and businesses more convenient but also has some disadvantages for security...

[Pictured above from left to right: Key Holder and Tracker and Aluminum Cardholder]

While countries like Australia and South Korea report that the majority of face-to-face transactions are contactless, the U.S. seems to be trailing far behind. This could be because merchants in the U.S. incur more cost per transaction when using contactless cards than other countries:

Although the U.S. has been lagging behind this global trend, Covid-19 is pushing businesses to switch over to contactless payment at the urging of consumers.

-

55% of American consumers worry about handling cash.

-

150% rise in the amount of contactless transactions in the U.S. since March 2019.

-

82% of consumers believe contactless transactions are the safest way to pay.

[Pictured above: Aluminum Cardholder]

Why contactless payment is more important than ever

When was the last time you saw someone clean their credit card? The answer is never. Studies show that credit cards may actually be dirtier than coins or cash. This isn’t necessarily because of the card itself, but because of what you touch right before and after using your card.

“Payment tablets, like the ones that patrons tap and sign with their bare fingers, were found to have more different types of bacteria than any other payment method studied.”

It has never been more important to keep your personal belongings and yourself safe from dangerous bacteria and germs, and to educate yourself on how they spread.

[Pictured above: Aluminum Cardholder]

The cleanest way to pay

The easiest way to stay safe it to reduce your contact with objects outside of your person and keep the items on your person clean. There are several ways to best do this:

-

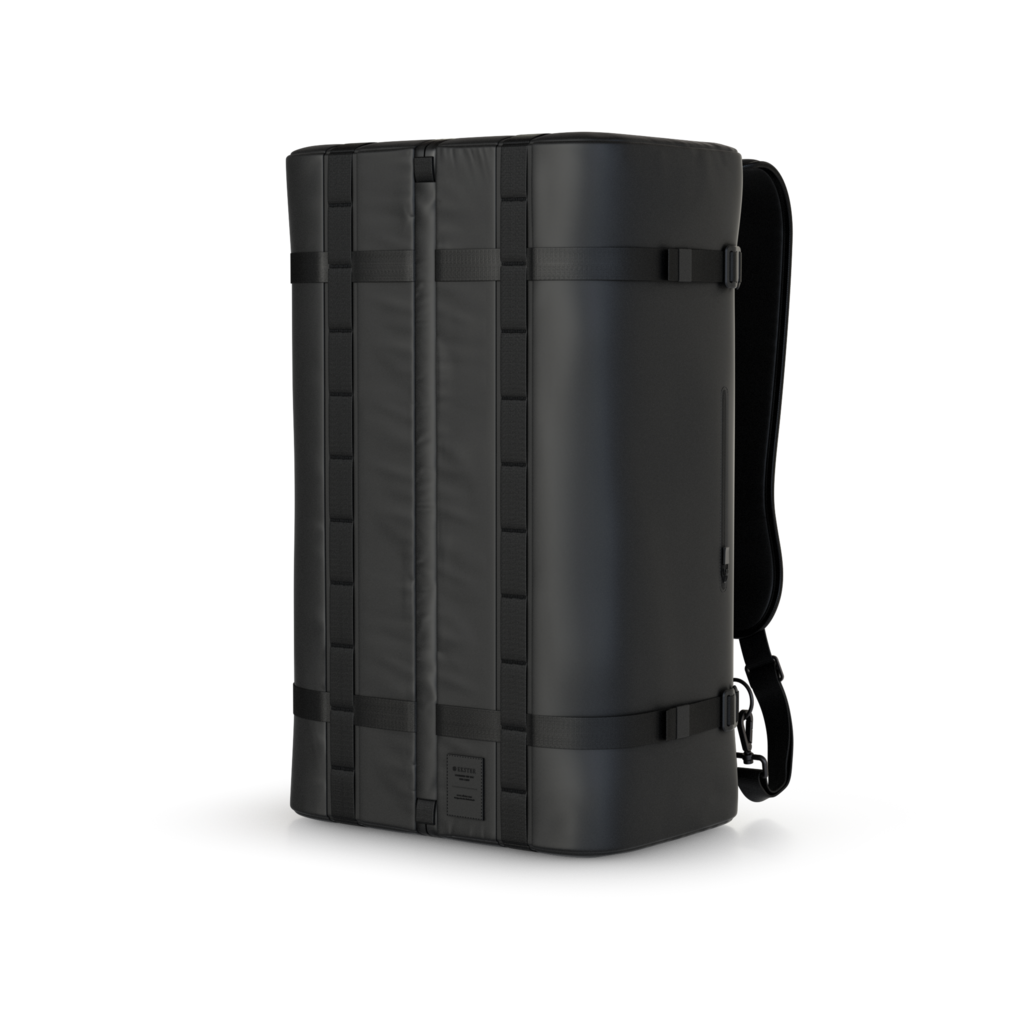

Use a smart wallet, like Ekster's Parliament Wallet, that has a dedicated spot for your most used contactless payment card so that you don't have to touch it and it doesn't have to touch anything.

-

Metal carries fewer germs and bacteria than plastic or fabric. Invest in an Aluminum Cardholder from Ekster that's made from space-grade metal making it easy to clean and inhospitible to germs.

-

Cards carry less germs than cash. Even if you can't always use a contactless card, any card is safer than cash or coins.

By reducing the contact your fingers have with signature pads, you reduce the opportunity for germs to get on your cards, cash or anything else in your wallet, and ultimately keep yourself safer.

The inventors of contactless payment probably didn’t imagine that their technology would be used to limit the spread of infectious diseases, but more often than not we can’t envision all the uses for our creations. While Covid-19 certainly didn’t create the need for contactless cards, it has absolutely sped up its integration, particularly in the U.S. But what we can say is that our future is looking more and more cashless by the day.