Getting Ahead: Finances for Fresh Grads

Life after graduation is exciting—you’re out in the adult world, which means it’s time to take on more responsibility. Whether you graduated in May or just accomplished your winter commencement, you’re probably feeling a bundle of emotions.

Yes, there’s excitement, but there’s also quite a bit of worry. Financial independence is something many people strive for yet struggle with. If that’s the case with you, take a look at these essential money tips for new college graduates.

Take control of your finances and get started on the right foot for your next adventure in life!

Pay Your Student Loans on Time

Student loans are one of the biggest money struggles college students have. While that monthly number may seem scary, it’s even scarier to avoid it. Make sure to pay off loans on time, and if you can, pay more than the minimum. The sooner you pay off your loans, the closer you’ll come to financial independence.

Create a Budget

A budget is vital to handling your money. Knowing where your money is coming from and where it’s going is essential for long-term financial health. Though it may seem tedious, the sooner you put pen to paper and figure it out, the easier saving and safe money handling will become. You should also think about downloading personal finance apps to keep your money even more in order.

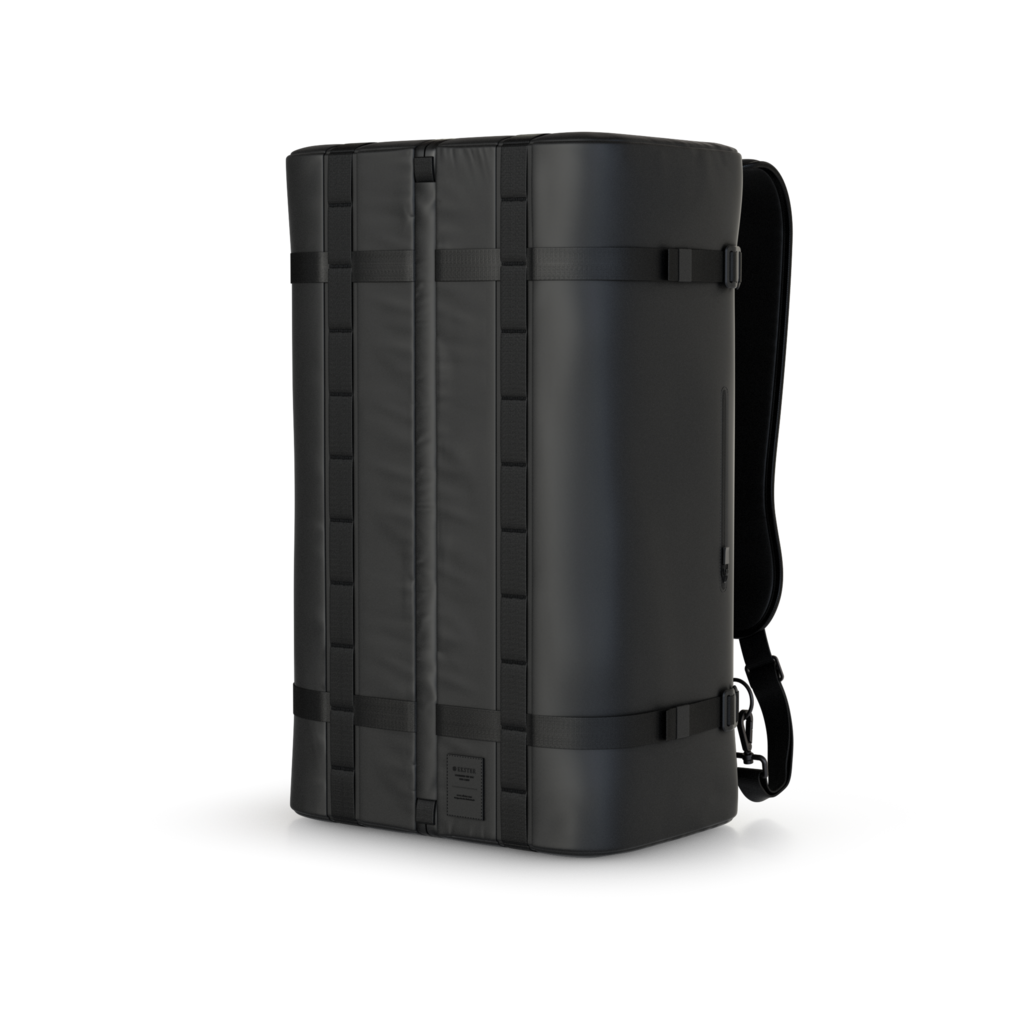

Keep Your Money Safe

Important for day-to-day security, but also important in general, is taking the time to keep your money safe. This comes in many forms—you want to make sure that you check your bank account consistently to keep identity theft at bay, you want to invest in a small GPS tracker for your wallet so you can always keep an eye on it, and you never want to carry too much cash on you. There are various little things you need to be wary of with your money to ensure it stays safe.

Live Within Your Means

A lot of students think that, since they’re out of college, they can spend a bit more freely with their money. Finding a job doesn’t mean that money spending can go crazy. In fact, think about it in the opposite sense—once you’re out of college you should be even tighter with money spending. In short, live within your means; don’t go spending a bunch of money that’s outside your set budget.

Start Investing

Truth be told, it’s never too soon to start investing. The sooner you start, the more time you leave for your money to grow. If you’re not quite sure where to start, read up on some general investment books or sign up for a basic app that will invest in safer stocks.

Build an Emergency Fund

Another vital tip delves into emergency funds. To reiterate this blog’s theme, the sooner you start, the sooner you reap the rewards. In this case, the sooner you start saving money and setting it aside (think 20–25% of each check), the bigger cushion you’ll have when something unexpected happens.

Diversify Your Income Stream

This money tip for new college graduates asks you to consider various job routes, including remote work no experience. Of course, your first “adult” job is exciting and wonderful, but it shouldn’t be your only job. If you want to be smart about your money, then consider starting a side-gig; it will bring in more income to your bank.

Turn to Ekster for help keeping your money safe. Our wallets with trackers ensure you know where your money is. Starting small with your money is a great start to gaining financial independence!