How Do RFID Wallets Work and What's The Point?

Cybercrime takes many forms, and in the 21st century, it is a far more prevalent concern than most other forms of criminal activity. The average citizen is more likely to have their information stolen online than experience any kind of physical theft or home burglary.

This isn’t to say you should be overly paranoid about cybercrime—just be prepared and know how to protect yourself from the various techniques hackers are using these days.

You probably already use tactics like two-factor authentication, facial recognition, or fingerprint scanning more often than not, and these are great ways to boost security from the comfort of your own home.

When you walk outside into public spaces, however, new threats emerge, and most of us are under-protected when it comes to this dimension of security. Hackers now use RFID-skimming methods to extract personal information directly from your credit cards, and you can quickly become a victim without even knowing what happened.

Let’s take a closer look at how RFID skimming works, why you should take proper precautions, and explain why an RFID-blocking wallet is truly your best defense against this new wave of digital crime.

How Does RFID Skimming Work?

To protect yourself from threats of any kind, you need to know what you’re up against. Hackers are typically hidden behind virtual private networks and don’t venture out into public, but RFID skimmers are roaming the streets, ready to swipe your info at any time.

How do they do this? With the same technology used to scan and identify radio frequency ID tags that we see in normal retail and industrial settings. A hacker can stand up to twenty feet away and use a scanning device to harvest your credit card number, your full name, expiration dates, and any other vital information that only you should know.

You can be casually strolling down the street, relaxing in a seat on a train, or meandering the aisles of a department store, and your info could be compromised in the blink of an eye. The worst part—you won’t know what happened until days later when you see fraudulent activity appear on your card statement.

This crime is virtually untraceable and can happen anywhere, which is why more people are looking to strengthen their defenses with tools like RFID blocking wallets.

RFID Skimming Stats To Know

There’s reason to be concerned about any type of cybercrime, but how serious is the threat of RFID skimming when compared to other forms of theft and fraud?

First, consider the sheer number of RFID units currently in existence, and recognize the growing number of industries that are leveraging this technology for new purposes.

The global market for RFID tags is growing rapidly, having risen from $12.6 billion in 2016 to an astounding $24.6 billion in 2020. From the retail industry to manufacturing and international logistics, RFID tags are more commonplace than ever. In fact, 96% of retailers now rely on this technology to organize inventory and speed up transactions.

What does this mean for you? With more RFID processes happening all around you, the greater chance you may encounter someone with bad intentions. The technology is growing more prevalent, and so are hackers who use it to steal.

To give you an idea of the damage done so far, more than 2 million victims of RFID skimming were reported in 2016, and that number is on a steady rise year over year. With a grand total of $16 billion stolen, that’s nothing to laugh at.

Digital pickpocketing is the 21st-century version of the old thief’s trick, and it’s our responsibility to shield ourselves from the threat.

Here are some of the more common places that RFID skimming is likely to happen:

- Restaurants (when your card is sitting on the table)

- Retail stores (walking slowly and focused on merch)

- Public transport (close quarters with strangers)

- Gas pumps (standing in place for several minutes)

- ATMs (little peripheral awareness and wallet out)

These are everyday scenarios that often can’t be avoided, and skimmers are becoming better attuned to these situations each year. It’s up to you to bolster your defenses and make sure that your essential info remains untouched as you navigate these scenarios.

Why You Need RFID-Blocking Capabilities

RFID skimming may not be the most common or dangerous form of digital fraud, but you can’t ignore the fact that it’s on the rise. If you carry around a credit card or debit card in your daily routine, you could end up a target—there’s no way around it.

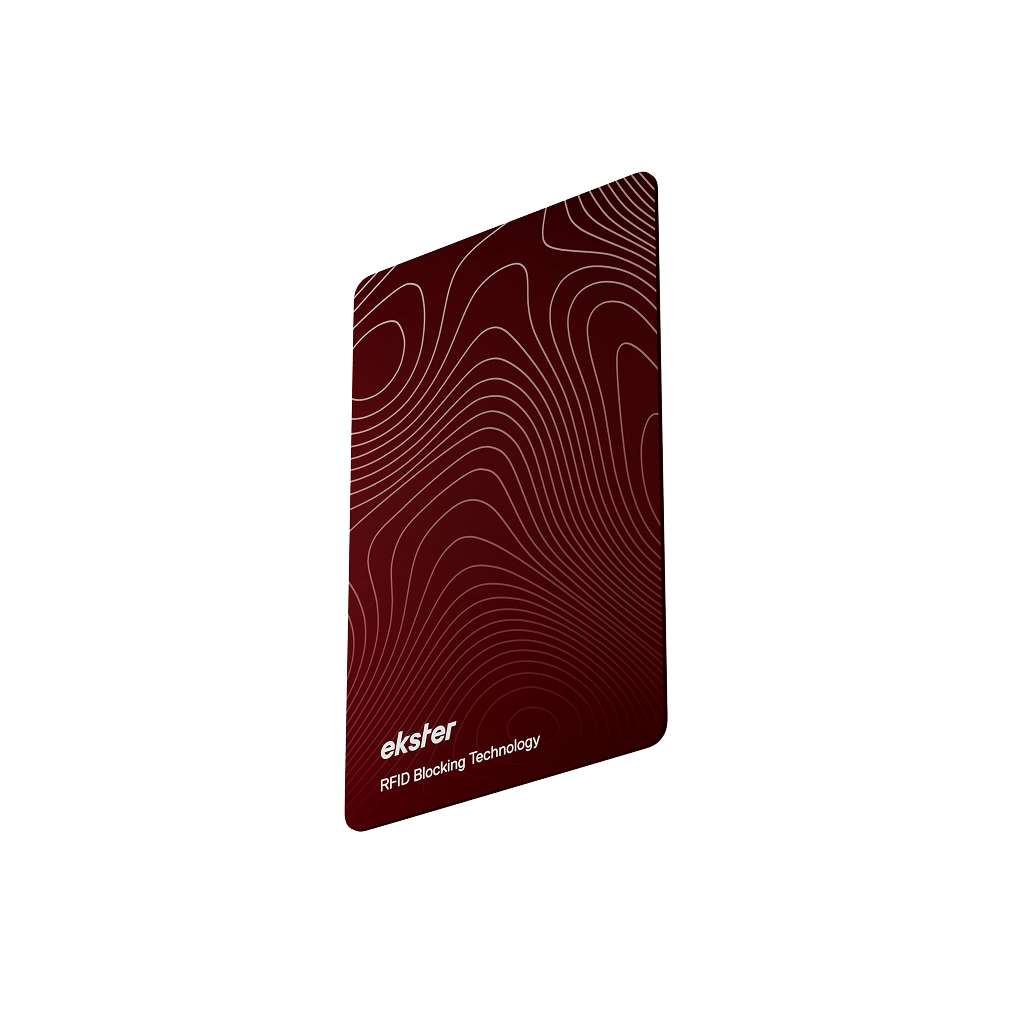

Rather than going cash-only and leaving your cards in the drawer every time you leave the house, you can strengthen your defenses by simply switching over to a smart wallet or carrying case that features RFID-blocking technology.

The blocking mechanism is fairly straightforward. There is a layer of protective metal embedded within the walls of the wallet or case that prevents RFID waves from entering the interior of the storage compartment. You can confidently move through the world without worrying about RFID skimmers stealing info right out of your pocket.

Luckily, you don’t have to compromise on style or functionality with today’s RFID-blocking wallets. They come in modern designs, several different materials, and plenty of colors so you can construct your ideal everyday carry and personal aesthetic.

If you’re more of a traditionalist when it comes to carrying cash and cards, you can also opt for a classic leather bifold wallet, as long as it has RFID-blocking capabilities.

While most wallets and cases will not be able to defend against skimmers, you should take the time to find devices that have this important feature and give yourself some peace of mind. Before you make your next wallet purchase, run down the feature list, and make sure all of your bases are covered in terms of RFID protection.

Other Tips To Keep Your Cards Protected

Shoring up your security with RFID-blocking cases is a great first line of defense against skimmers, but there is always more you can do to minimize the risk of digital fraud.

For example, you can switch up where you keep your wallet to throw thieves off track. Most folks keep their wallet in the same back pants pocket, leaving them susceptible to digital (as well as physical) pickpockets. Keep your wallet in your front pocket or jacket during cooler months.

Remember to also stay aware of your surroundings when roaming the streets and shops in your city, especially on the weekends during peak hours. Scammers are far more likely to be out and about when crowds gather to conceal their identity. Keep your eyes open for suspicious activity, and don’t linger for too long in a single spot.

Finally, be sure to monitor your credit card statements frequently. This is the only indication we have to determine if fraud has occurred, so don’t go more than a few days without taking a glance at your statement online. If something fishy pops up, don’t hesitate another second to contact your bank and clear things up.

Conclusion About RFID Wallets and RFID Skimming

RFID skimming is real, but you can do a lot to defend your financial data and stop hackers in their tracks. Pick up an RFID-blocking wallet, stay vigilant, and you’ll have no trouble avoiding these traps.

Sources:

https://www.nerdynaut.com/the-shocking-stats-on-card-skimming-fraud

https://www.idx.us/knowledge-center/rfid-skimming-is-the-danger-real

https://www.ifsecglobal.com/global/understanding-rfid-skimming-infographic/