RFID Card Holder: Do They Work?

When speaking of the credit and debit cards most people carry around with them on a daily basis, security is an absolute must-have to safeguard the sensitive information they contain.

Nobody wants to have to deal with the pains of having to fight back against monetary or identity theft. But, as technology advances and our spending habits head more and more into the digital realm, we begin to face new challenges in the fight against scammers and their technology that is, as well, always advancing further.

The newest technology in card design is what is known as Radio Frequency Identification, or RFID for short. While this technology brings with it faster, more convenient transactions, it also brings about new ways in which criminals can access and steal your private information.

But, how do they go about getting into these chips? Well, let’s first talk about what RFID technology is, then we can go into how thieves can exploit this tech for their own gains.

So, What Is RFID and How Does it Work?

The technology behind RFID chips is the next step in the evolution of card-based transactions. It is a safer way to store information than its predecessor, the magnetic strip.

Magnetic strips were the standard method of storing the information in cards, up until recently, using magnetic fields to arrange iron or other magnetic substances inside the strip in such a way that the magnetic contact reader could decode into the information.

One of the biggest flaws of this technology is how easily these strips can be completely erased if the person carrying the card accidentally got it too close to a powerful enough magnetic source, thereby, rendering the card useless unless it is either replaced or reprogrammed.

RFID chips, on the other hand, are completely safe from being erased in such a way. They are solid-state chips, meaning they have no moving parts at all, and simply store the information required.

They have built-in antennas that allow them to communicate with contactless card readers via radio signals when the chip is powered by electromagnetic energy produced by the reader device. And this is all done without any contact having even been made between the chip and the chip reader.

So, Where Is the Danger?

The danger in the RFID chips comes from the exploitation of the way the chips work. Their use of radio and electromagnetic frequencies for remote communication with their readers.

Even scarier is the fact that if you were to become a victim of one of these types of crimes, you wouldn't even be aware until after the possibly serious damage has already happened.

A scammer can simply create or even buy an RFID card scanner and modify it to greatly increase the range at which it functions. An increase in the electromagnetic field is all it takes to reach several feet away to activate and access cards in any unprotected wallet.

That will cause the card chips to activate and essentially broadcast out their stored information through radio frequencies, which can be recorded with the same scanning device—all without any type of warning whatsoever to you.

You would have absolutely no idea anything had even taken place until days or weeks later when your cards are being used by someone else and when your name and information start popping up on new credit checks and card applications that you never asked for. By then, you will be in for one major headache trying to get it all sorted back out and recover your personal data.

How Would an RFID Cardholder Help Avoid That Possibility?

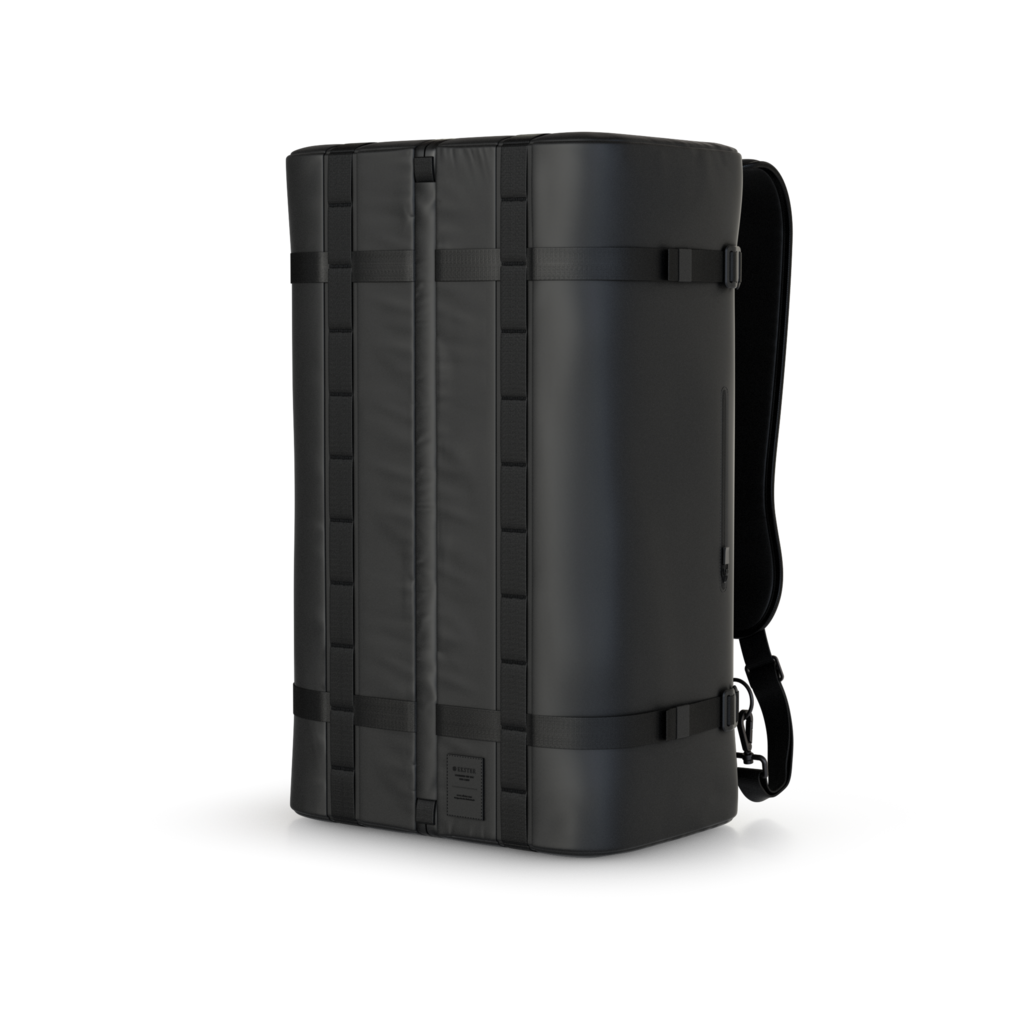

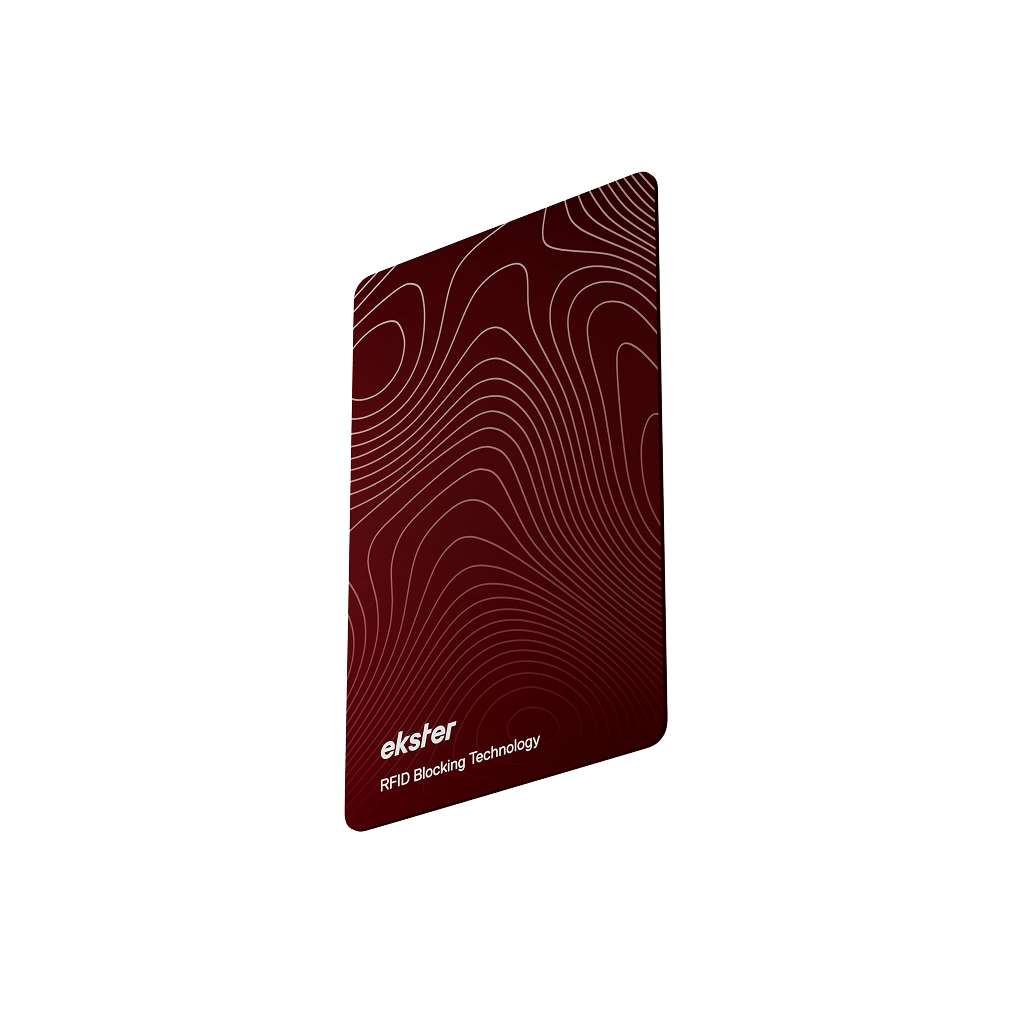

RFID cardholders are called such because they are specifically designed with the purpose of safeguarding your cards in mind. The energy waves that scammers use to access these chips in cards may be invisible, but it is not unstoppable. By borrowing an idea from science known as a Faraday cage, wallet manufacturers have come up with a solution to this problem that they refer to as RFID blocking technology.

In a nutshell, RFID blocking is done by making the frames of the cardholder, or indeed, the entire cardholder out of a metal that will absorb and dissipate energy waves across its own surface, as opposed to letting it get through. By doing so, the electromagnetic fields generated by the card skimming devices are completely unable to reach the chip.

Due to the way they function, that makes the chip unable to communicate its information with the power provided by the electromagnetic field. If the cards can’t be activated, there is no way to read the information. And even if the field could penetrate the shell of the cage, the radio frequencies sent back from the card would be even less likely to break through and return.

So, not only does the blocking tech work to help stop the unknown access, it makes it virtually impossible, allowing you to be free from the worry of having the highly sensitive information hijacked and turning everything upside down. And since protecting this information is one of the more vital security measures you can take, it only makes sense to add this passive technology into your arsenal in the fight against fraud and identity theft.

Do They Work, or Don’t They?

When considering whether or not RFID cardholders work, the only logical conclusion is that they absolutely do serve their intended security purpose, and they do it well.

By keeping the activating electromagnetic field from even reaching the cards, the holder completely negates the possibility of them being skimmed remotely without your knowledge or consent. The last time we checked the math, zero possibility was just about as safe as you can get.

People spend vast amounts of time and money attempting to recover their lives after it has been wrecked by a scammer who managed to gain access to their personal information.

It’s the type of situation that absolutely nobody wants to have to deal with. So, isn't it worth at least looking into something so simple that you can do to help protect yourself from becoming another in an ever-growing community of people who have fallen prey to fraud and identity theft?

You may have heard the old saying that “it's better to have it and not need it than to need it and not have it.” It basically means that when you have the option to plan ahead for any eventuality, it is never a bad idea to do just that. Even if you aren’t familiar, this type of situation is exactly the sort of “just in case” scenario that it is referring to.

If you ever come across someone with a skimming device, you can either never even need to know, or you can deal with the easily avoidable catastrophe that can ensue after having your information stolen.

Ultimately, the choice is up to each individual whether to use an RFID cardholder for their everyday card-carrying device. But, with so much at stake in the event that you become a victim, it will be a protection that you won’t even realize how glad you are to have had in place beforehand. Get ahead of the problems, and secure your finances.

Sources: