What to do when you lose your wallet

Losing your wallet can be a heart-breaking, panic-inducing, and generally less-than-pleasurable experience.

While cards and cash are somewhat replaceable, your wallet is the sort of accessory that you grow attached to. It’s with you everyday, it goes wherever you go, it holds your identity, your money, maybe some pictures of your family.

Though your wallet isn’t necessarily something that stands out most of the time, its absence is deeply felt, and the ramifications of losing it can waste time, money, and your patience.

Here are the most important things to do right after you lose your wallet, and how to prevent it from ever happening again.

7 things to do when you lose your wallet

1. Is it lost, misplaced, or stolen?

The first thing you need to know is whether it is lost, misplaced or stolen. If stolen, you obviously want to cancel all your cards, but doing this prematurely just to find your wallet a couple hours later can mean you’re left waiting for days for your new cards to arrive in the mail.

Maybe you are the sort of person who wants to exhaust every possible avenue before calling it quits and canceling all or cards, or maybe you can’t afford to have your wallet stolen for even a minute, so you place it safe.

The way in which you go about finding your wallet will differ slightly depending on your situation, lifestyle and personality.

2. Retrace your steps

See through the panic and try to think clearly - when is the last time you had your wallet or the last time you paid for something?

If you happened to be at a bar or club there could be certain factors working against the clarity of your memory. Apart from physically retracing your steps, another good thing to do is call all the establishments you last went to — a restaurant, a store, what be it.

Hopefully someone will have found it and turned it into the front desk for you to pick up.

If this doesn’t solve the problem, try looking in hidden spots. Check all the pockets of your most worn jackets and pants, look in the washing machine or dryer, and don’t neglect under the couch cushions.

If all this fails, it’s time to consider next steps.

3. Know what’s in your wallet

If you’ve come to the conclusion that your wallet’s gone for good, you’ll need to start canceling and replacing cards.

Before you can go about doing all this, you need to know what was in there to begin with. Start by making a list of everything you can remember being in your wallet.

Little things like a gym membership or an old gift card can come back to haunt you as they, too, hold private information and possible funds, so make sure to include even the most seemingly mundane items.

Once you have a list of all the things in your wallet, you can start going through one, and by one and canceling them to prevent fraudulent use.

4. Contact your card issuers

Credit cards are one of the most important things in your financial arsenal. If you’re absolutely certain your wallet has been stolen and you’ve exhausted every possible place it could be hiding, it’s time to call your card issuers to let them know to block your cards.

Doing this could help you save hundreds, if indeed someone has your cards and is trying to use them. Every card has a specific phone number, usually 24/h, that you can call to have your card blocked immediately. Make sure to do this for every debit and credit card you have.

You also have the right to ask for a free credit statement, which is a log of every transaction you’ve made on a certain card.

This way, you can check to make sure there aren’t any fraudulent transactions, and if there are, get your money back using the purchase protection insurance that exists for most credit cards.

5. Report your loss to the police

It may seem a bit extreme, but oftentimes having an official police report for a missing or stolen wallet can help with a plethora of different procedures you may need to do to replace all of your wallets contents.

For example, when replacing a passport or a government issued identity card, your local office may require a police report before they can issue you another card.

Furthermore, if your wallet does show up somewhere, it’s more likely to get back to you if it’s marked as missing.

It’s also important to mark your wallet as stolen if it contains your ID card. Passports and ID cards are sold for hundreds or thousands to create fake identities for people to travel, make purchases and even take out loans.

The only way to prevent this is to let your local authorities know that anyone using this passport or card isn’t you.

6. Replace your driver's license

This is perhaps the most annoying part of losing your wallet: standing in line at the DMV. Every American over the age of 16 knows this painfully boring experience, but it’s better to get it over with then to get caught driving without a license and incur a hefty fine.

Depending on your state, you will be required to show certain documents, usually a proof of identification. If your ID card was also stolen, this can prove very difficult as you’ll need to wait until your ID is replaced before you can go about replacing your wallet.

Some states also limit the amount of times per year you can replace your wallet, so it's best to not make it a habit.

7. Replace your wallet

Turn lemons into lemonade and use this as an opportunity to upgrade your wallet. You’ve probably had the same old bifold for years now, with worn out, gaping pockets, broken zippers and faulty clasps.

The last couple years have seen a total revolution in wallet design with the emergence of what people are calling “smart wallets”. They are named such due to innovative design and in the incorporation of technology.

Once key feature of modern wallets is a slim profile. This innovative design reflects the fact that as a society we move around much more often and at a heightened pace.

Urban living and everything that comes with it has engendered a turn towards minimalism that seeks to optimize smaller spaces and faster-paced lifestyles. The slim wallet takes up less space and means you only carry what you really need on you.

Apart from mobility, modern wallets are also designed in a way that responds to the general trend of replacing cash with cards. Nowadays, people don’t need huge wads of cash, and many only need an ID, travel card and credit card to leave the house.

Certain models, like the Ekster Wallet, center around a cardholder with a card access mechanism. At the click of a button cards are ejected and presented in a staggered fashion, making card access easier, and checking out quicker.

How to prevent losing your wallet

Losing your wallet once is already one time too many. Here are some ways to prevent your wallet from ever getting lost again.

- “Lost Wallet” apps

Your physical cards don’t matter as much as the information and access they contain. “Lost Wallet” apps make a copy of the contents of your wallet and password-protect them on your phone.

This doesn’t actually protect your wallet from loss or theft, but it does make it easy to recover the information stored in your wallet.

However, this can be more dangerous than it is protective because cell phones and computers are vulnerable to hacking. Hackers can easily install ransomware on your computer or use an open wifi connection to get into your phone.

- Get a tracker card

A tracker card for your wallet is the most foolproof way to prevent loss and find your wallet quickly if you do happen to lose it.

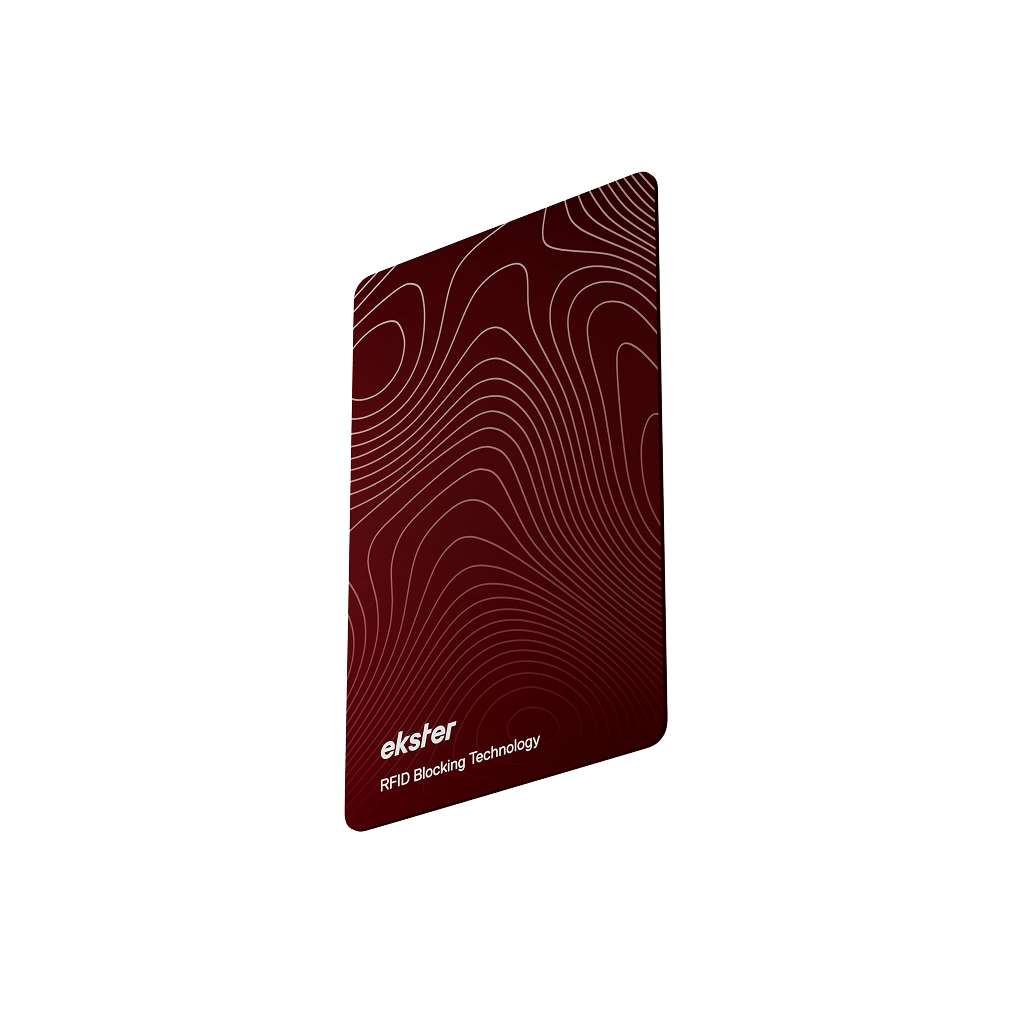

Tracker cards, like the one from Ekster, are slim devices, about the size of a credit card, that contain advanced technology that can be linked to the Apple Find My app on your phone.

Similar to 'Find my iPhone', you can add your Finder Card tracker to your devices on the app and start tracking its location globally.

All you have to do is slip one of these little guys into your wallet, camouflaged as just another card, and it will make your wallet virtually unlosable.

- Get a wallet that prevents identity theft

Stealing your wallet isn’t the only way to steal your information. As technology advances, more of our lives are becoming digitized, from banking and healthcare to socialization and entertainment.

But for every advanced form of security, there is an advanced form of hacking that exists to counteract it.

Nowadays, it’s easier than ever for someone to steal your personal information or identity. This can be done through hacking your computer, or the computer system of a police station or hospital (this happens shockingly often), and even through the cards you carry on your person.

You’ve probably heard of RFID, the technology used in contactless cards when you can hover a card near a reader to complete a transaction without entering your pin code.

You’ve probably heard of RFID, the technology used in contactless cards when you can hover a card near a reader to complete a transaction without entering your pin code.

What you probably haven’t heard about is the counterfeit ‘skimmers’ that can be used to steal your personal information in the same exact way without you knowing.

All someone needs to do is hold a skimmer near your pocket, wallet or purse to steal your information. Since you don’t need to enter a code, your card assumes you’re cognizant of this transaction. You could wake up to fraudulent charges without your wallet even being stolen, left to wonder what could have happened.

Luckily, brands like Ekster have contracted this problem with the creation of RFID-proof wallets.

These wallets use metal to block the radio waves used to communicate between a card and a reader (or skimmer). With one of these wallets your cards need to be removed in order to work, so you can rest easy knowing your information won’t be stolen (literally) from behind your back. Genius.

No matter what your situation is, losing your wallet is downright annoying. The accessory itself can be highly sentimental, the contents are integral to your daily life and the time needed to replace everything can cost you hundreds of dollars.

No matter what your situation is, losing your wallet is downright annoying. The accessory itself can be highly sentimental, the contents are integral to your daily life and the time needed to replace everything can cost you hundreds of dollars.

Now you know what to do when you lose your wallet, and how to prevent it from happening in the first place.